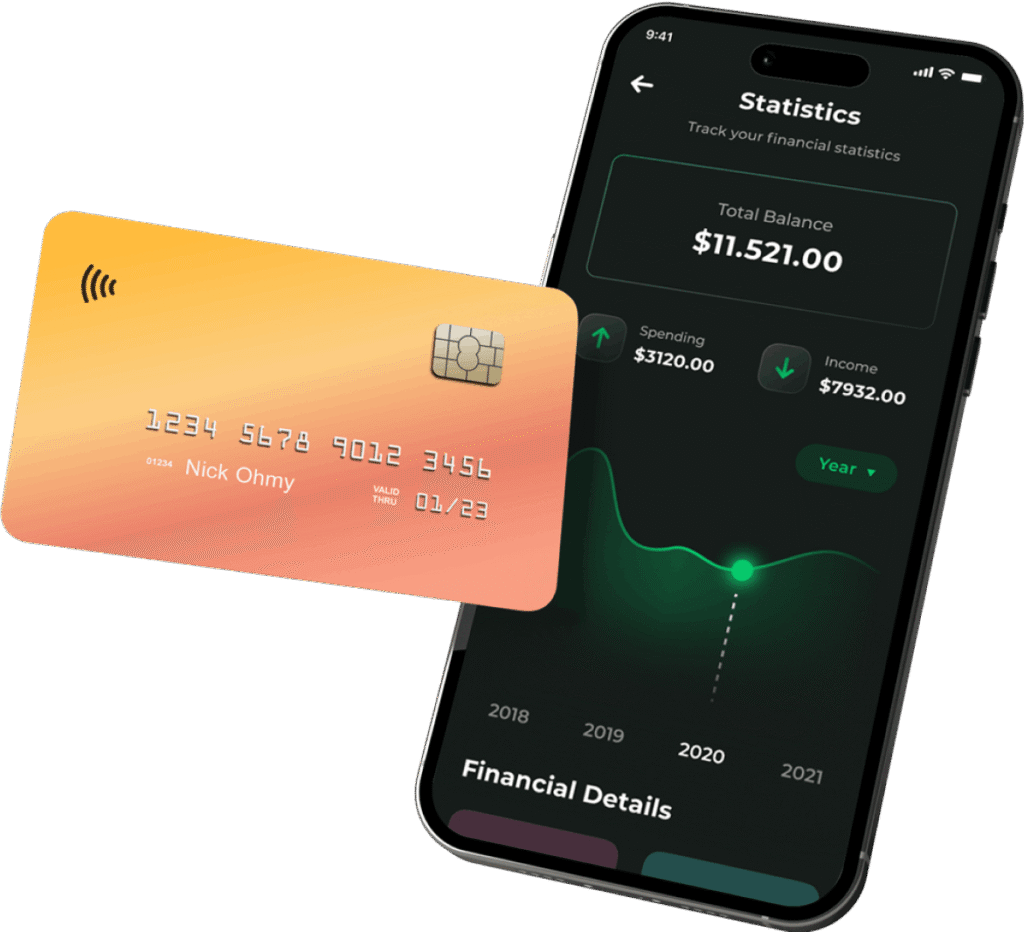

Empower Your Finances

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

About

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled.

38+

Business have

already joined us!

Business have

already joined us!

0%

Zero percent fee

to any transaction Zero percent fee

to any transaction

So many people like this service

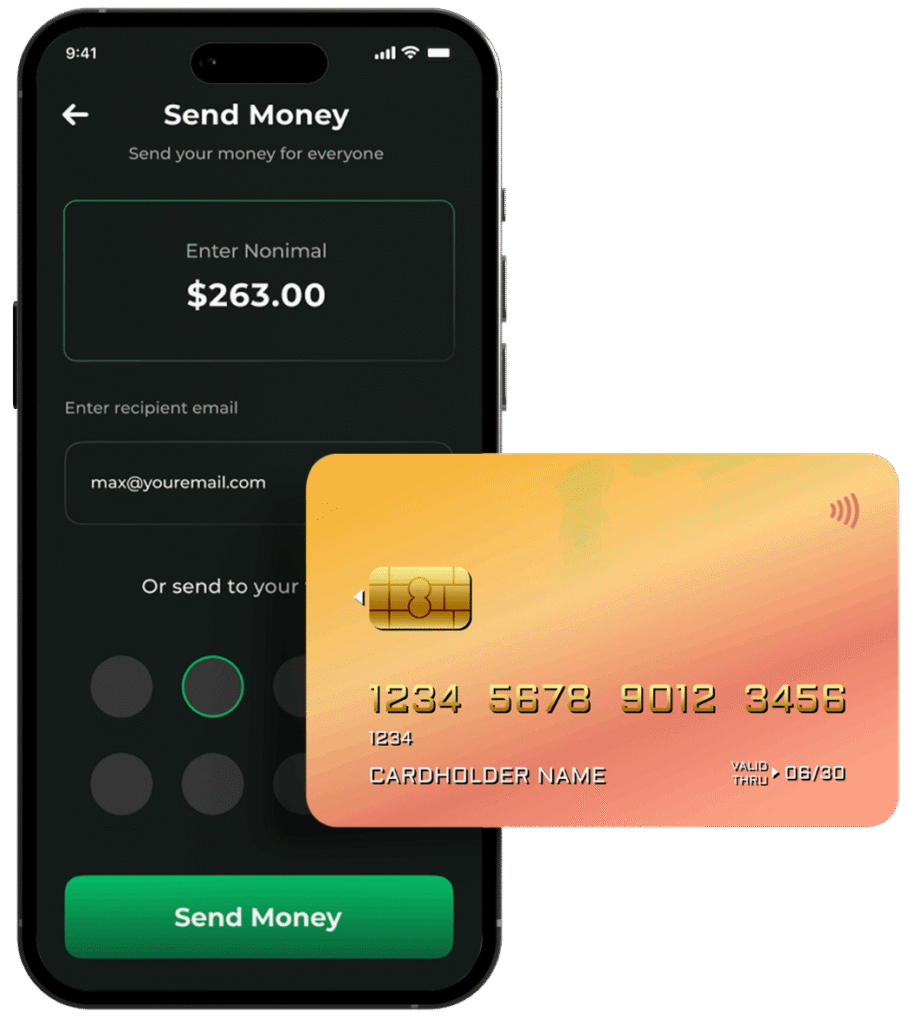

Unlocking the Power

of Digital Payments

Lorem Ipsum is simply dummy text of the printing and typesetting industry when an unknown printer took a galley of type and scrambled..

Market Share

Lorem Ipsum is simply dummy text of the printing and typesetting dummy industry.

Market Share

Lorem Ipsum is simply dummy text of the printing and typesetting dummy industry.

Market Share

Lorem Ipsum is simply dummy text of the printing and typesetting dummy industry.

Simplify Your Payment Processes

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled.

Create Account

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

User Configuration

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Enjoy Full Access

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Exceptional Services and Solutions

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled.

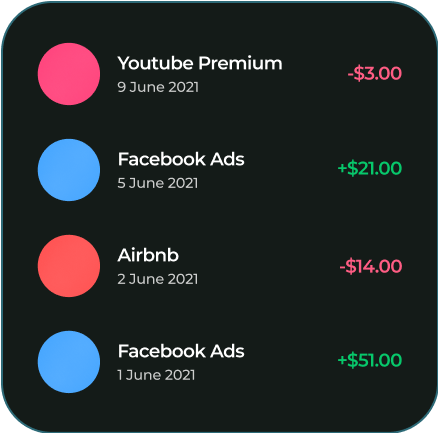

Anytime Transaction

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Anytime Transaction

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Replacing complexity with simplicity

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text.

Economical Pricing Options

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled.

Lorem Ipsum is simply dummy text of the real printing.

$1.54/ month

Lorem Ipsum is simply dummy text of the real printing.

Trusted By Professionals

Lorem Ipsum is simply dummy text of the printing and typesetting industry when an unknown printer took a galley of type and scrambled..

Review Text

Review Text

Review Text

Frequently asked questions

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. In vitae turpis massa sed elementum tempus egestas sed.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. In vitae turpis massa sed elementum tempus egestas sed.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. In vitae turpis massa sed elementum tempus egestas sed.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. In vitae turpis massa sed elementum tempus egestas sed.

Subcribe Our Newsletter

Get latest news and updates

- Feature

- Pricing

- About Us

- Faq

Copyright © 2025 Ouriken Consulting. All Rights Reserved.

Powered by Ouriken Consulting